Enterprise resource planning (ERP) software: This is typically only used by the very largest companies.It can also be delivered via subscription as SaaS (Software as a Service) or from the cloud. It used to be installed from a CD-ROM, but most commercial accounting software is now downloaded from the software vendor and installed on a desktop or workstation computer. Commercial software is usually available as a downloadable application. There are also a variety of add-on modules to choose from. Commercial accounting software: This ranges from simple applications that offer bare-bones features to full-service applications that offer complete accounting functionality.There are three types of accounting software applications that are typically used. What are the different types of accounting software? Most accounting software applications allow you to export your reports to Excel, where you can customize them if you wish the difference being that you're starting with the correct numbers. Microsoft Excel lovers shouldn't feel too bad.

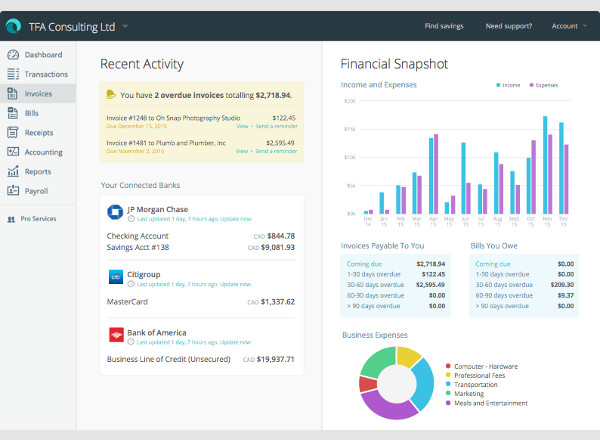

If that information is accurate, so are your reports (see image below). When you use accounting software, your reports are prepared using information you've already entered into the system. Professionally prepared reports give your business credibility. Transposition errors, extra decimals, decimals in the wrong place, extra zeros, not enough zeros these are all things that can happen when you use spreadsheet programs to create reports manually. Let your accounting software do the heavy lifting and provide you with the tools you need to always be compliant. If you have employees, you'll have payroll taxes that need to be paid on time such as federal withholding, state withholding, Social Security and Medicare taxes, and unemployment taxes. You’ll be able to charge your customers the correct tax rate while also running reports that show how much tax is owed to each tax agency. Instead of consulting multiple files to see how much you're spending, how much you've been paid, or how much is still owed, you can view all this information from one central dashboard.Īs the QuickBooks Online screen (above) asks, how often do you file sales tax? Using the appropriate accounting software will enable you to remain compliant with all tax agencies. You'll always know the financial status of your business How will you know how healthy your business is if you have no idea who owes you money or how much money you've spent in the last six months? How will you convince a bank to give you a credit line if you can't show them that your business is financially healthy? Perhaps most important, how will you keep track of your various tax obligations if you're not adequately tracking sales tax, use tax, employment tax, and employee withholding tax?īelow are some of the benefits of using accounting software. Still others use it to keep a better handle on their business expense categories. Others use it because they want to know how much money they're making, or in some cases, not making. Entering a customer into a software application and creating an invoice is much easier than entering that same information into a spreadsheet, and then having to create an invoice in another application. Some use it because it simplifies the entire record-keeping process. Smart business owners use accounting software for a variety of reasons. Everyone who is in business should be using some type of accounting software since it's impossible to measure their company’s financial health without it. That includes the contractor you hired to write a press release, the property management company that you pay your rent to each month, your mortgage holder, your doctor, and your attorney. However, everyone in business should use accounting software.

I'd like to say that anyone in business uses accounting software, but unfortunately, that's not the case.

0 kommentar(er)

0 kommentar(er)